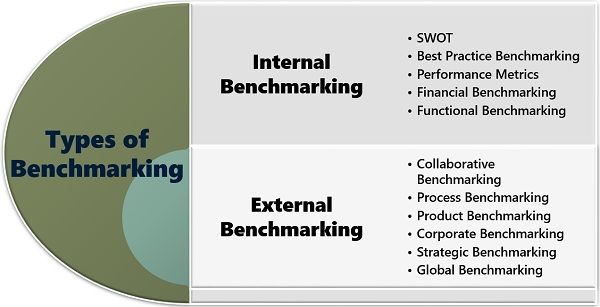

As a result, the most commonly used indexes are those created by large broker-dealers that buy and sell bonds, including Bloomberg Barclays Capital (which now also manages the indexes originally created by Lehman Brothers), Citigroup, J.P. Because stocks trade on open exchanges and prices are public, the major indexes are maintained by publishing companies like Dow Jones and the Financial Times, or the stock exchanges.įixed income securities do not trade on open exchanges, and bond prices are therefore less transparent. Numerous other equity indexes have been designed to track the performance of various market sectors and segments. Using an index, it is possible to see how much value an active manager adds and from where, or through what investments, that value comes. Indexes represent a “passive” investment approach and can provide a good benchmark against which to compare the performance of a portfolio that is actively managed. Because indexes are unmanaged, they track returns on a buy-and-hold basis and no trades are made to reallocate to securities that may be more attractive over different market cycles or market events. An index tracks the performance of a broad asset class, such as all listed stocks, or a narrower slice of the market, such as technology company stocks. In most cases, investors choose a market index, or combination of indexes, to serve as the portfolio benchmark.

Swap: The sale of one security for the purchase of another.Currency risk: A form of risk that arises from the change in price of one currency against another.Credit risk: The risk of loss of principal or loss of a financial reward stemming from a borrower’s failure to repay a loan or otherwise meet a contractual obligation.As the term implies, credit quality informs investors of a bond or bond portfolio’s credit worthiness, or risk of default. Credit quality: One of the principal criteria for judging the investment quality of a bond or bond mutual fund.Broker-dealers: A person or firm in the business of buying and selling securities, operating as both a broker and a dealer, depending on the transaction.

#Benchmark meaning in us government plus

Bonds are interest bearing and promise to pay the holder a specified sum of money at its maturity plus interest at given intervals. Bonds: An instrument of debt issued by a corporation or government to raise capital.

0 kommentar(er)

0 kommentar(er)